Background The COVID-19 pandemic had a very adverse effect on Nepalese farmers and rural communities, especially the agriculture sector, which is facing multiple challenges. Thus, to address these existing problems, revive farming and enhance the livelihood, NACCFL had undertaken the implementation of the ARISE Revolving Fund as a national implementation agency (NIA) at the national level targeting especially the smallholder farmers/producers seeking production assistance for the immediate next cropping season. The ARISE fund was disbursed through the NACCFL network and Central Tea Cooperative Federation (CTCF). The fund was disbursed to 19 primary cooperatives (14 from within the NACCFL network and 5 from CTCF) covering 5 provinces and 12 districts. The total individual beneficiaries were 1370 farmer members among which more than 80% are women members. Moreover, the target beneficiaries include the marginalized and indigenous members of Nepal such as the landless Tharu community, chepang[1] and endangered community such as bankariyas[2]. This project intends to financially support the farmers to cope with the harsh situation created by the pandemic spread and to return to normalcy. In addition to this, the project also assisted to capacitate FOs/primary cooperatives for enabling them to facilitate to link their farmer members with the market.

Innovations/Good Practices

The methodology applied in the disbursement of the ARISE fund based on the partnership between the federation and primary cooperatives and among the federations is itself an innovative model. This model is new in the context of access to finance as well as the access to skills by the target beneficiaries. This innovation also facilitates the timely disbursement as well as the recovery of the fund. Moreover, in some of the target areas of ARISE fund which were nearby the service center, few farmers were tied up with the service center. There was the piloting of transforming subsistence farming into integrated commercial farming in the technical support of the very center.

Here are some of the good practices which are replicable and applicable in the future:

- The involvement of the FOs for the implementation, monitoring, and capacity development of the target beneficiaries of the project with better transparency.

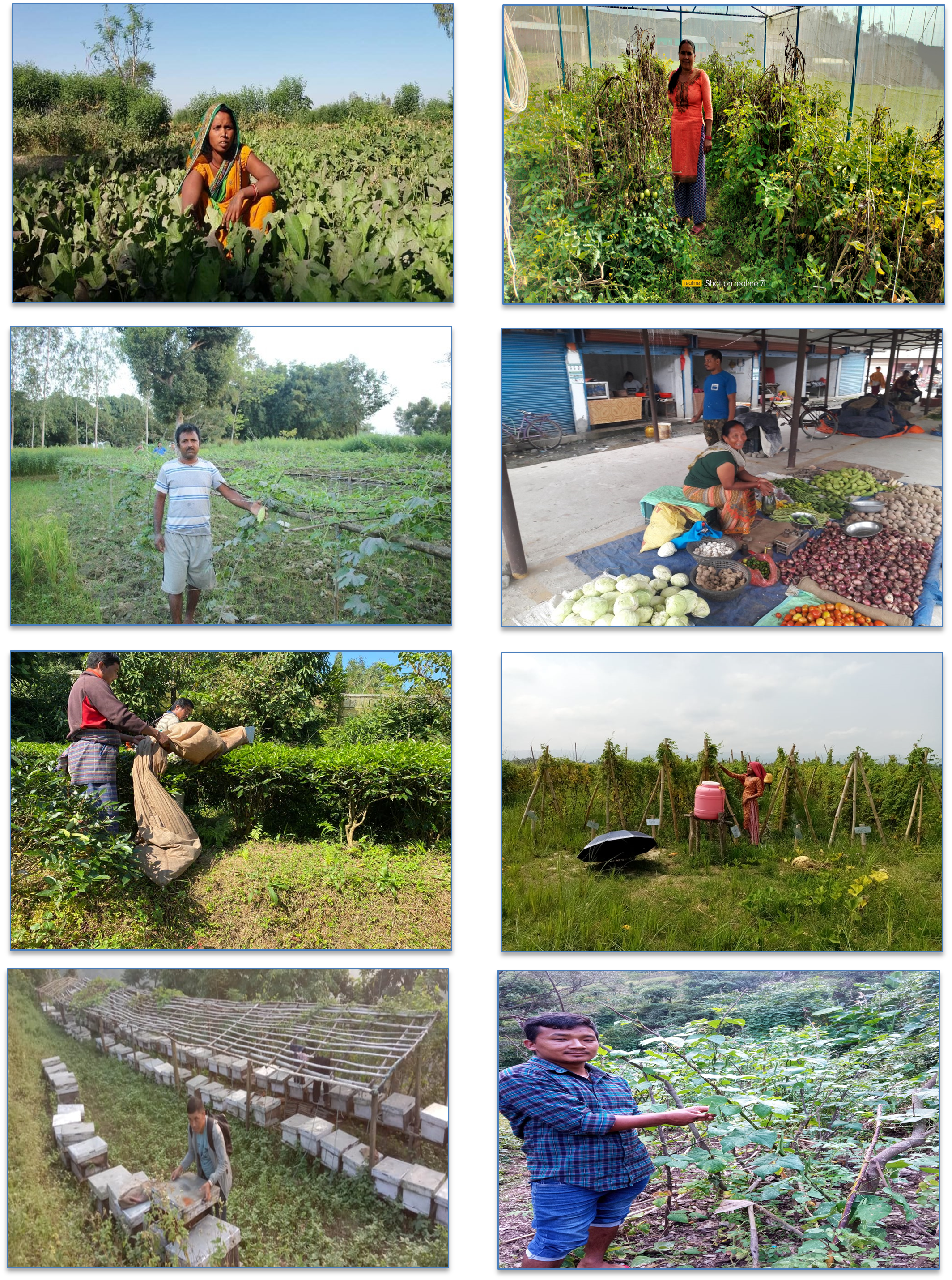

- Primary cooperatives such as SFACL Jogimara of Dhading and SFACL Kakada of Makawanpur had disbursed the ARISE fund to 100 members from the Chepang community (50 in each). The Chepang members from Dhading are engaged in vegetable production whereas members from Kakada are involved in poultry farming, improvement of beehives, and some vegetable farming. Chepangs from Kakada are widely known as beekeepers and are their main occupation. Honey produced by the Chepangs is being marketed by the NACCFL(NIA).

- In the same way, SFACL Manjari, Gadawa from Dang had invested in one of the landless women indigenous communities –the “Tharu” community. The farmer beneficiaries are using the for the vegetable production. These women farmers are tied up with the vegetable collection center established by their cooperative in support of NACCFL(NIA).

- Similarly, the fund had also benefitted one of the most marginalized and endangered communities of Nepal Bankariyas. Out of the 15 Bankariyas who are members of SFACL Handikhola, 8 had been provided with the ARISE fund and are using the fund for vegetable farming, pig farming, and goat rearing.

Impact

The total benefitted household from 19 primary cooperatives under NACCFL and CTCF were 1370 farmer members among which more than 80% are women members. Moreover, the target beneficiaries include the marginalized and indigenous members of Nepal. The fund was directly disbursed to the farmers’ members as a production loan for only one cycle. Most of the loans were used for vegetable farming whereas some of the members utilized them for various purposes such as tea garden management, poultry farming, livestock farming, and beekeeping.

The ARISE fund had been very impactful at the community level as it allowed easy access to the low-cost financing among the benefitted farmers amidst of the pandemic spread even to the most endangered and marginalized community members which in turn supported enhanced their livelihood. The major impact of this project is seen in the increase in their income level through access to finance and access to skills. It had acted as the relief fund during the harsh situation created due to the pandemic. It is also observed that there is a rise in the income of beneficiaries which ranges from 10% to 25% of increment. Moreover, these primary cooperatives had also facilitated the marketing of the agricultural products produced by those beneficiaries. Farmers are linked up with the local markets as well as with the district, provincial and central level markets through their respective cooperatives. Similarly, as the support from the ARISE had been injected to the small farmers, most of them are in the way to expanding their business activities in wide range in collaboration with relevant stakeholders.

Facilitating Factors

The major actors in the process of actualizing the innovation include the government of Nepal, NACCFL, CTCF, primary cooperatives, target beneficiaries, and some of the market actors (transporters, wholesalers/marketers). The collaboration and participation among these actors played a vital role in the successful implementation of the project. The structure of NACCFL is one of the most important facilitating factors which enables the fund to be disbursed as well as repayment by a large number of target beneficiaries in a very short span of time. In addition, the assistance of the government of Nepal to support the small farmers of the very rural part of Nepal also facilitated the successful implementation of the project. Similarly, with the introduction of a federal structure in Nepal, local level government plays a very active role in supporting agro enterprise of small farmers. Thus, though with the the beneficiaries are also supported with different types of subsidies from the local

government for example in support of transportation, irrigation system, local markets, and so on. Thus, the favorable policies backstopped the target beneficiaries to carry out their respective agricultural activities.

Challenges

- During the initial stage of the implementation of the project, receiving the approval for the use of funds from the central bank was a major challenge but was overcome with the continuous lobby and advocacy of NIA to the concerned stakeholders.

- Farmers were a bit reluctant to take the fund due to fear of inability to repay the fund along with service charges amidst restrictions in the lockdown due to the COVID pandemic spread.

- The restrictions also lengthen the process for applying for the ARISE fund by primary cooperatives and FO.

- Despite farmer beneficiaries receiving the ARISE fund there lies the challenge of marketing the agro produces produced by them.

Lending Experiences of NIAs to FOs Lessons Learned

- The methodology applied in the disbursement of the ARISE fund based on the partnership cum coordination between the federation and primary cooperatives is itself an innovative as well as an effective model in terms of access to finance, and access to skills, and repayment which is replicable and applicable in the future.

- The fund had created easy access to financial resources even to the most endangered and marginalized community of Nepal, which in turn enhanced their livelihood.

- The strength or capacity of NIA for the dissemination of the fund had been realized, as the fund had been disbursed to more than 1300 smallholder farmers in a very short period whereas NIA is still receiving the demand for such funds from other cooperatives as well.

- This project had been playing a supporting role in increasing the number of members in some of the cooperatives as this project had disseminated the positive message to other non-members in the community.

- This project had been the motivational factor for the small and marginalized farmers to be engaged in the agricultural sector and the beneficiaries of this fund can be considered the local champions at the community level.

- Collaboration and participatory approach: Collaboration with FOs and primary cooperatives and their active participation from the very beginning to the end of the project seem to be very important for effective and efficient implementation of the project

Recommendations

- An increment in the loan amount per cooperative and per individual farmer should be made.

- Extension of the Loan period to a minimum of a year

- Activities should be made broad (For an example: Poultry, fishery, tea, coffee, cardamom, fruits, processing industry (small and medium), value chain development (production, processing, marketing)

[1] Chepang is an indigenous ethnic group living in Central and Southern Nepal and also known as one of the isolated tribal groups of Nepal.

[2] The Bankariya are a small group of tribal people who live in an isolated region of central Nepal. They were traditionally hunger-gatherers of the forest. Most Bankariya preferred the settled life in a village to their old nomadic ways. Even today, Bankariya villages are inaccessible by cars, buses, planes or boats.

Discover more from APFP / FO4A / ARISE

Subscribe to get the latest posts sent to your email.

Comments are closed